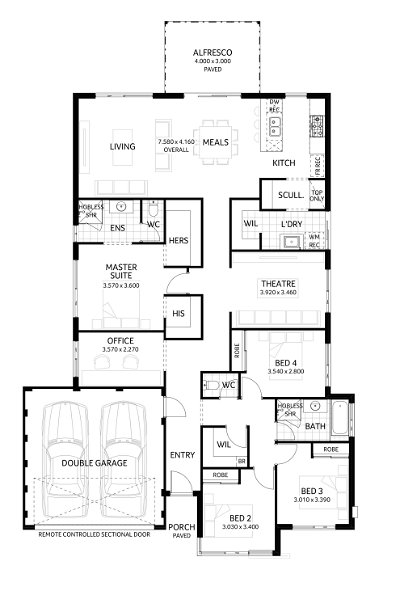

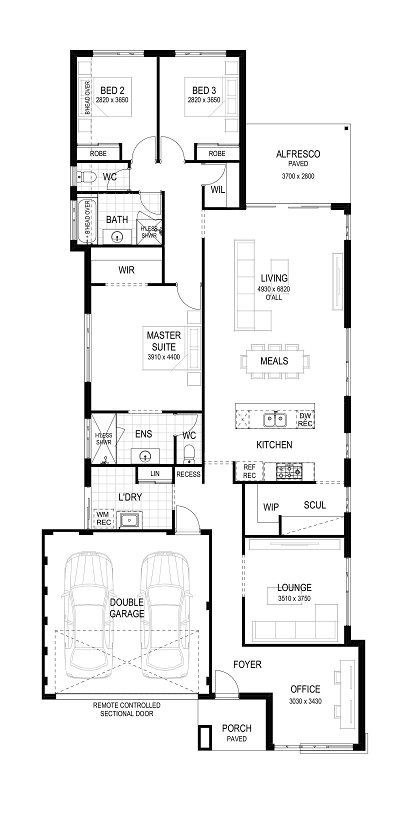

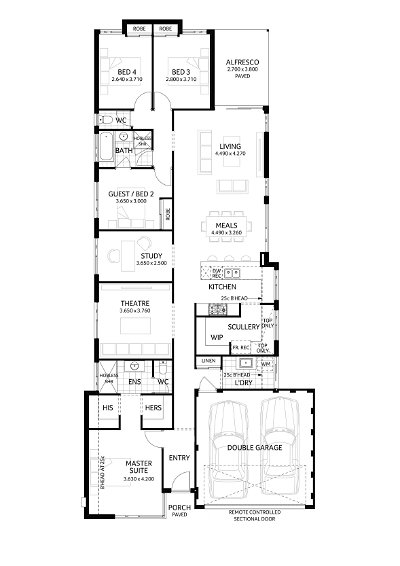

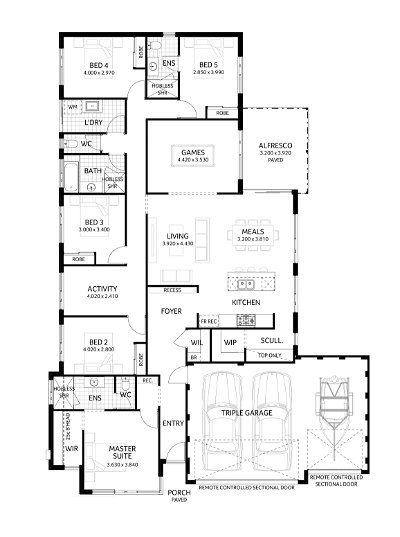

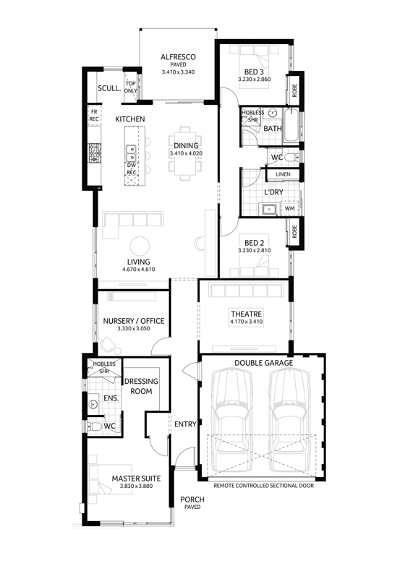

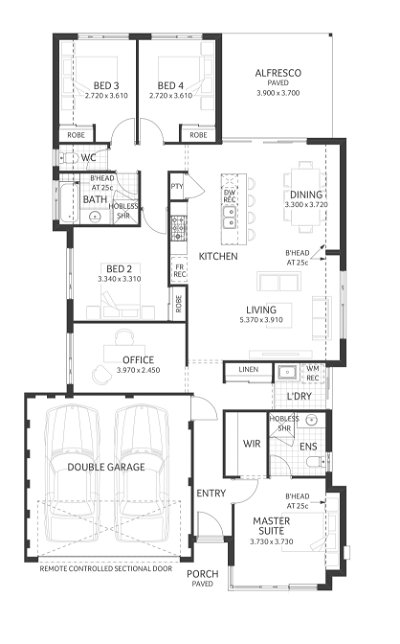

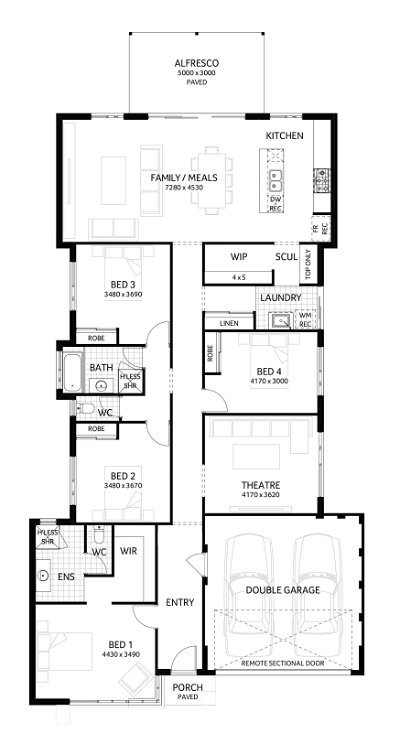

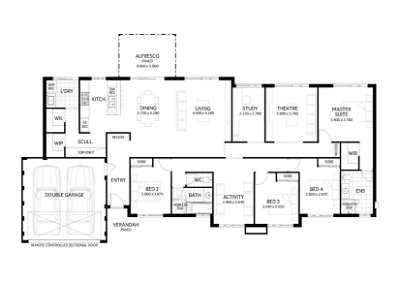

Home Designs

Our award-winning modern home designs have been refined over the last 120 years to cater for the ever-changing Western Australian lifestyle.

We have house designs to suit every family and every budget. Whether you know what you’re looking for, or simply need inspiration to get started, you’ve come to the right place. Browse through our collection of home designs to get a taste of what your dream home could look like.

Our home designs cater to a variety of styles from classic Federation style homes to Hamptons style homes, plus retro-cool Mid-Century and the always popular Contemporary style homes. Whether you’re looking for a single storey, double storey, narrow lot design, country style home, dual occupancy design, or turnkey home, we can start from scratch and customise a home that’s perfect for you!